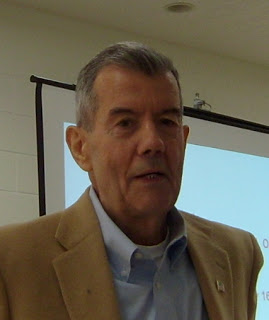

Bill Helming, an agricultural economist based in Kansas, says the Iowa and Ontario farmland prices are in a bubble.

Bill Helming, an agricultural economist based in Kansas, says the Iowa and Ontario farmland prices are in a bubble.He figures it will burst within the next five years and prices will come down by 25 to 40 per cent.

There will be a lot of pain if and when that happens, much as there was when a similar bubble burst in 1980. That time it was a combination of rising land prices, aggressive expansions and soaring interest rates.

This time Helming says interest rates will not only stay down, but even the rates on 20 and 30-year U.S. government bonds will be coming down.

A Farm Credit Canada accounts agent commented that a 25 per cent reduction would only bring Ontario farmland prices back to the level two years ago.

But that will be small comfort to those who have taken out big mortgages to buy or refinance farmland at current market prices.

Helming forecasts a period of deflation because of rising unemployment, lower wages and debt reductions by households, businesses and governments.

Helming says the deflation will be widespread, encompassing North America, Europe, Japan and China.

He made the comments during a special invitation to speak to the annual meeting of the Waterloo Cattlemen's Association.

I hope the politicians in Ottawa are watching and bail out of ownership of Farm Credit Canada as fast as possible. As a taxpayer, I don't want to be on the hook guaranteeing the FCC loans portfolio.